A Deep Dive Into My 2025 P&L

Last week, I talked through my 2025 Financials and historical trends at a high level (you can catch up here, if you missed it). This week, I’m diving into the details.

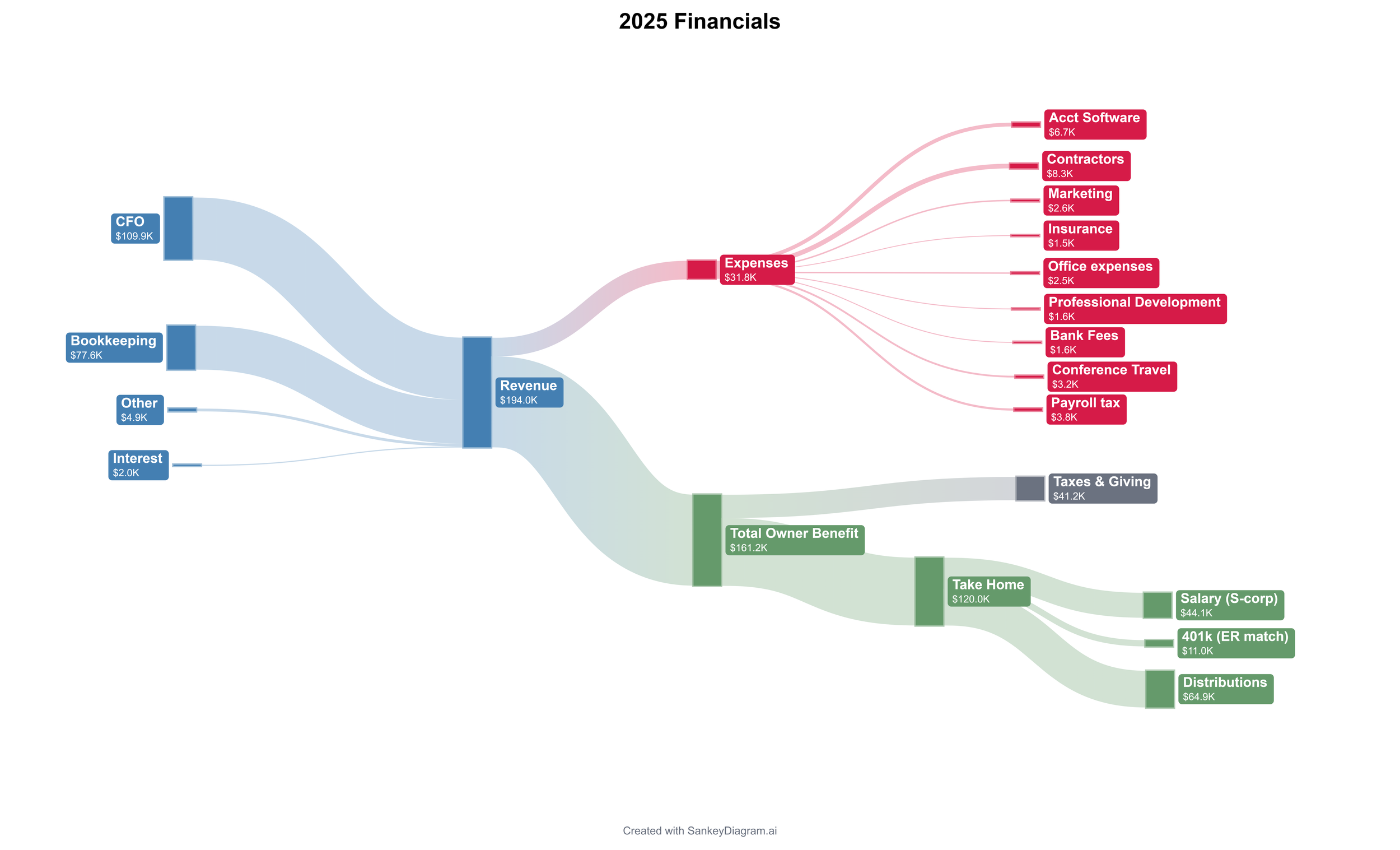

I would normally do this with a traditional P&L, but I really wanted to see it laid out in a Sankey this year, so that’s the direction I went. (What’s a Sankey?) I think a P&L is great for the IRS and SEC, but leaves something to be desired for seeing the big picture of the business.

All the data is the same, but I think it helps to answer a lot of questions we’d normally have on a traditional P&L like: What’s included in Wages? Did you have retirement contributions? Yada yada yada.

Okay, here we go (it’s a lot and you may need to zoom in to see the actual numbers)…

First Off

The visual of how big the green flow (total owner benefit) is compared to the red flow (expenses) is a testament to the solo / almost-solo firm margins. Yay for tiny firms!

Revenue

Almost half of my $194K revenue came from CFO clients (this also includes any bookkeeping services we would provide them). Everything else is bookkeeping-only, strategy sessions, and interest from a 12-mo CD that I kept my cash reserve in.

Expenses

About $32K, or 16.5%, gets gobbled up by expenses.

Accounting Software ($6.7K) - this is all QBO subscriptions that I pay for my clients, Fathom, and a small amount of ProConnect that I use on my own firm & family returns

Contractors ($8.3K) - this is all my non-US-based bookkeeper who works 0 to 10 hours a week and I pay on a monthly fixed rate; I point-blank asked her in our monthly call yesterday if I was paying her enough and she said we were good - phew. I told her to let me know when that’s not true anymore.

Marketing ($2.6K) - website refresh in 2025, podcasting, client gifts (I know these are not all deductible!), and I tried Sam’s List at the end of the year (meh)

Insurance ($1.5K) - switched to CAMICO last year (no regrets)

Office Expenses ($2.5K) - a big chunk of this is my very expensive Starlink internet which, quite literally, the only thing that works for my business where I live and my cell (Mint Mobile…super cheap…$180/yr)

Conference Travel ($3.2K) - such a big part of my expenses budget, but so worth it; I usually budget $3-4K for 1 conference per year; Bridging the Gap was my pick in 2025 and will be again in 2026 (actually hoping to speak there this year because I loved the vibe so much last year)

Total Owner Benefit (my made up metric)

The rest of the $161K pre-tax money goes to me :o)

Taxes & Giving ($41.2K) - since I started this firm in 2018, I’ve given a percentage of annual Total Owner Benefit to domestic violence organizations in the areas where my clients are located, it’s ranged from $10k-20k per year in recent years; obviously, this is a personal choice, but worth calling out here for transparency; I also choose to be a law abiding citizen and pay my federal and state income taxes 😏

After-Tax Take Home ($120K) - this comes to me in the form of salary as an S-corp owner (yes, I have a reasonable comp analysis supporting this number), employer-side 401k contributions to my solo 401k (another incentive to stay solo), and the rest can come out in distributions (or sometimes I keep it in my business to fill my reserve)

Did you make it? You still here?

That was a lot.

Always happy to answer questions if you want to hit reply.

Hope this helps,

Erica

**if you’re curious, I made this Sankey in SankeyDiagram.ai (not at all sponsored). And special thanks to reader Dan R for sending me an email when he heard I was doing this and pointing out that many of these Sankey software have Excel Add-ins (::wheels turning::)

What’s Happening in Aligned

So much good stuff happening in Aligned right now. First, the most important thing:

DISCOUNT CODE: $10.99 off your first month new or returning to Aligned in celebration of 1099 season being done (first month = $64.01); use code 1099OFF at checkout until EOD Friday.

Aligned Super Bowl Challenge: FREE to enter. 10 questions like: How long will the national anthem take? or What color will the Gatorade dump be? 1 point for each right answer, top 3 scores win $75/$50/$25 DoorDash gift cards to get you through busy season

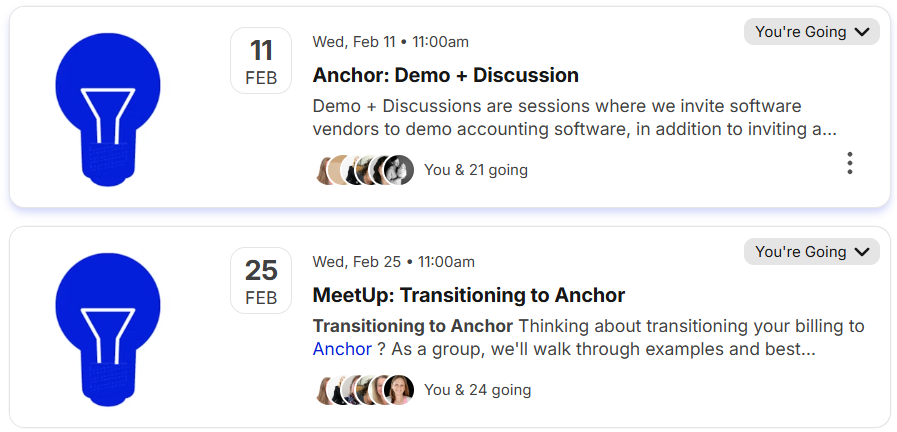

Thinking about transitioning to Anchor in 2026?

This is not at all sponsored by Anchor (seriously), but we did invite them to come on the 11th. We’ve just had a lot of Anchor discussion in Aligned in late 2025, so we want to support the people who are looking to transition to this platform.

**times below in MST

Offering Advisory & CFO Services > last week’s meetup was jam-packed with attendees and info.

If you’re thinking about joining, don’t forget to use code 1099OFF to get your first month for $64.01 (you could actually make money on your first month if you win the Super Bowl Challenge 🤣)

Join the discussion with 170+ like-minded, non-scaling accountants / really cool humans in the link below. $75/mo, no commitment - come and go as you please :o)

Money back guarantee, if you get in there and don’t see the value. No questions asked.

More details in the link above.