Sharing My 2025 Solo Firm Financials

My books (and my clients’ books) are officially closed for 2025.1099s are filed and accepted.

Now I just need to field or dodge all the “quick” tax questions from friends, neighbors, and extended family during the next few months. (No joke, this happened to me at our small town grocery store this very morning…a 15-minute conversation, while I stood next to spinach.)

Okay, in the spirit of helpful transparency, not bragging (2025 wasn’t a bragging year anyways), here are my 2025 financials at a high level…

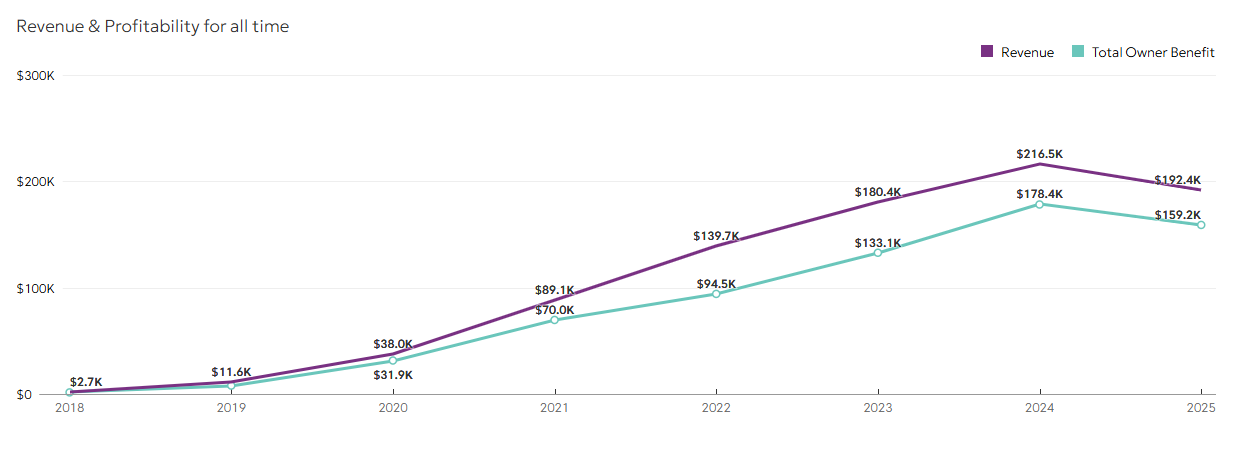

Revenue

Dipped ~10% to $192K related to client downgrades and churn due to the economic bumps and uncertainty that 2025 brought. (If you’re new, I’ve been talking about this in real time in the newsletter, so feel free to catch up in the archive.)

None of these downgrades or churn happened in January 2025, so I’ll continue to feel the wrap-around effect of them in the beginning of this year. 2026 will definitely be a clawing-my-way-back-up / rebuilding year.

Total Owner Benefit

This is a homegrown metric I use with my clients that includes any pre-tax financial benefit the owner receives from the business, regardless of where it hits on the P&L. In my case, this includes my salary (as an S-corp owner), employer-side solo 401k contributions, and remaining profit. It’s likened to “seller’s discretionary earnings” in a business you’re selling. But I’m not selling, so it feels weird to use that term.

TOB was down, consistent with revenue. Fortunately, my husband and I have spent most of our adulthood living below our means, so our family didn’t feel any impact from this. Thankfully, this is more of an ego blow than a financial blow.

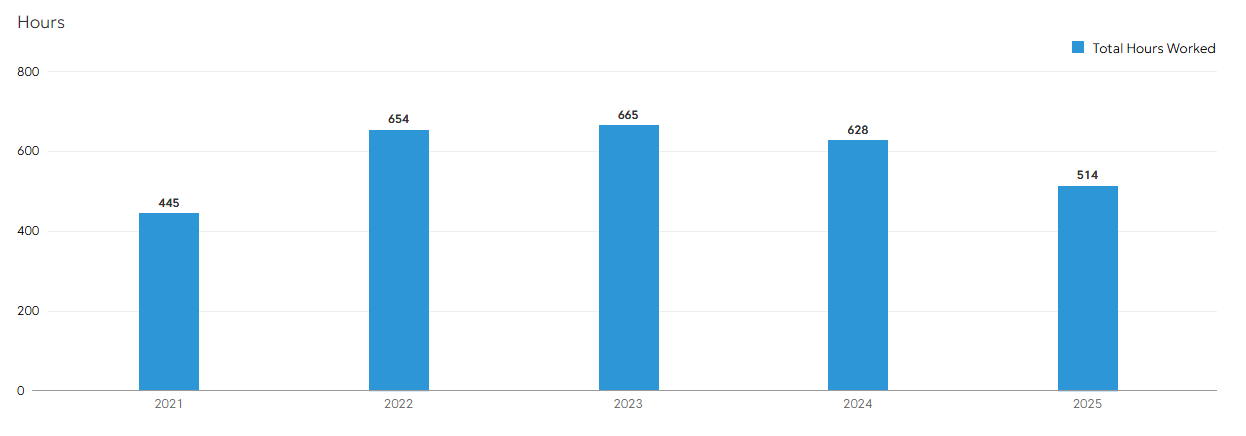

Hours Worked

On the bright side, with less client work, came fewer hours worked. I track my hours meticulously (I didn’t before 2021) for internal, never client-facing, purposes. Yes, that’s 514 hours for the whole year, including client work, admin, marketing, etc. Those hours exclude anything related to Aligned Accountants, writing this newsletter, or listening to podcasts that count for CPE while I walk or drive.

And yes, I know 514 divided by 52 weeks comes out closer to 10 hours per week. Please don’t take my 15 Hour Accountant crown away.

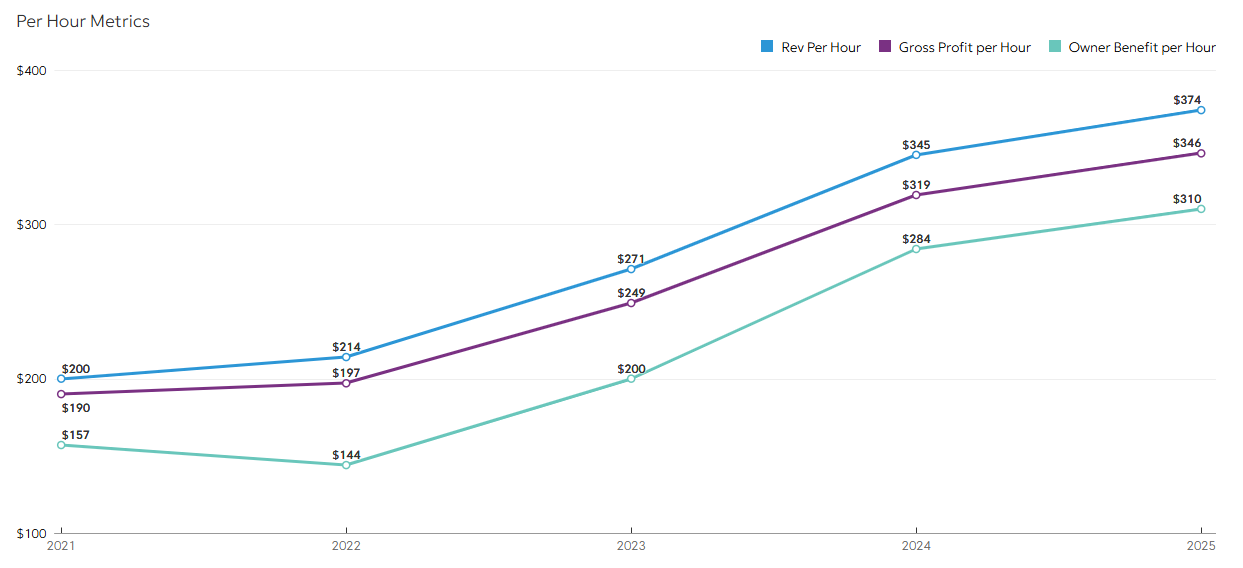

Profit Efficiency

This was my saving grace that reframed my mind around 2025.

I made less money in 2025, but I continued to get more profitable for each hour I worked.

If I plan to stay solo (and I do), this is the only way I can scale me.

Coming up next week…

I’ll dive into my 2025 P&L at a more detailed level so you can see how cash flows through my business.

Hope this helps,

Erica

**if you’re curious, all graphs in this email are directly from my firm’s Fathom reporting. With the exception of revenue and profit, every other metric you see is a custom KPI I’ve created for my reporting.

What’s Happening in Aligned

MeetUp: Offering Advisory & CFO Packages

TODAY!! - 11am MST > RSVP Here

I’ll be talking through example CFO-level offerings and walking through my monthly client meeting structure. Lots of time for Q+A! Still time to join live if you hop into Aligned now!

Anchor: Demo & Discussion

Wed, Feb 11th - 11am MST > RSVP Here

MeetUp: Transitioning to Anchor

Wed, Feb 25th - 11am MST > RSVP Here

Question of the Week > Capacity check: What client capacity are you at heading into Q1?

TEMPLATE ADDED: Offboarding / Disengagement Checklist

Join the discussion with 170+ like-minded, non-scaling accountants / really cool humans in the link below. $75/mo, no commitment - come and go as you please :o)

Money back guarantee, if you get in there and don’t see the value. No questions asked.

More details in the link above.